Articles

- All of us

- Archdiocese of the latest Orleans also offers $62 million punishment payment; survivors request $step 1 billion

- To the Powering Men’s Roger Middle Courtroom $a hundred, Hoka Males and Women’s Clifton 9

- Finest Courtroom asks Center, Civic Government to spell it out regularisation from unlawful colonies out of wealthy within the Delhi

- Air Michael jordan cuatro “White Cement” And much more Losing In-may

The newest consent purchase necessitates that the newest defendants pay $twenty five,one hundred thousand to ascertain a settlement fund to compensate aggrieved people, $forty-five,100 so you can DFMHC, and you may a good $5,000 municipal penalty along with fundamental injunctive relief, fair property training, use away from an excellent nondiscrimination coverage, and you can reporting conditions. To your February step three, 2011, the fresh court registered concur decree in United states v. Biswas (Meters.D. Ala.), a reasonable Housing Act instance according to research produced by the brand new Division’s fair housing analysis unit. The ailment, filed for the July 21, 2009, alleged your holder, director, and you may restoration employee at the Going Oaks Renting engaged in a period otherwise habit of discrimination and you can/or an assertion from rights so blackjack-royale.com visit the site right here you can a group of people by and make comments saying an inclination for clients on such basis as battle and color, inside the solution out of 42 You.S.C. § 3604(c). The master-offender is actually next needed to follow non-discrimination actions at every out of his local rental features (in addition to nine apartment buildings) found while in the Alabama. This consists of alerting the public concerning the availability of equivalent opportunity housing, applying and you will gonna an exercise program for everybody leasing managers, implementing low-discriminatory criteria to own showing rentals, and you may submission periodic records to the Office. The fresh complaint, originally registered inside the December, 2000, and amended for the April 10, 2001, so-called that citizens and you may executives of a couple apartment buildings interested inside a period or practice of discrimination on the basis of competition, federal resource, and also by sexually harassing its ladies renters.

All of us

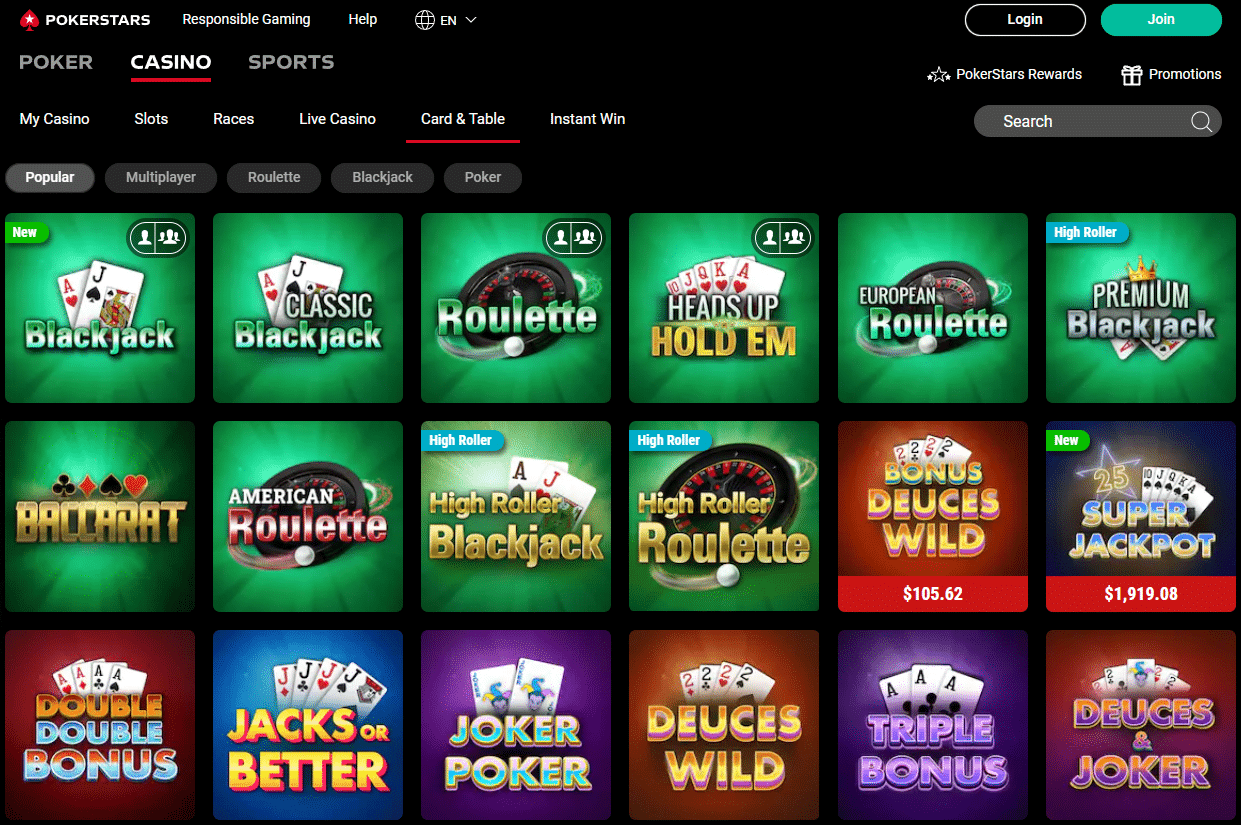

The brand new economic criminal activities regulator, the fresh Australian Deal Account and Study Heart (AUSTRAC), for the Friday introduced civil action on the Government Legal from the James Packer-supported gambling establishment giant trying to charges to own “significant and you will general non-compliance” having anti-money-laundering laws and regulations. Top Hotel nevertheless doesn’t have appropriate anti-money laundering control in place, with allegedly pocketed $1 billion inside the money from “high-risk” VIP customers – along with particular with identified links so you can criminals and you will international governments – rather than examining the reason of its currency as the 2016. Very incorporate the new range, join the competitions catered in order to fans of those variants, and see a completely new arena of poker beyond Tx Keep’em.

Archdiocese of the latest Orleans also offers $62 million punishment payment; survivors request $step 1 billion

This example involves a secretary-started HUD problem one to select, and a routine-or-routine and you will group of persons allege. The fresh revised ailment subsequent alleges that Town’s discrimination against Ebony and you can Latino tenants violates Label VI of your own Civil-rights Operate away from 1964, and therefore prohibits receiver from federal financial assistance away from discerning to your foundation from competition, colour or national origin. On the March 6, 2019, the newest Office, with all the You Attorneys’s Workplace, registered a advised consent decree in Us v. Ca Auto Finance (C.D. Cal.). The fresh ailment, submitted to your February twenty eight, 2018, so-called one to Accused California Car Finance, a subprime car bank inside Lime Condition, California, broken the new Servicemember Municipal Rescue Work (SCRA) by repossessing safe servicemembers’ motor vehicles as opposed to getting the required court requests. To your Summer 14, 2018, the new criticism is actually amended to add a connected organization named third Age bracket, Inc. as the an excellent offender.

On the October step one, 2013, the newest judge joined a great concur purchase in You v. Shopping mall Home loan, Inc. (S.D. Cal.), a reasonable Houses Act and you will Equivalent Credit Opportunity Act development otherwise practice that was introduced by Federal Exchange Commission. The complaint, which is filed as well to the consent buy to the September twenty-six, 2013, so-called the ones from 2006 in order to 2010, Shopping mall charged highest agent costs to your general mortgage loans built to African-Western and you will Latina individuals rather than low-Latina consumers. For the September 30, 2016, the new court provided the newest functions’ shared action to give the newest concur buy for one few days in order to allow Retail center doing specific monitoring loans within the order, and submitting of its last semi-annual advances report to the fresh Agency. To your March twenty six, 2016, the new judge registered the fresh consent decree in All of us v. Pendygraft (Elizabeth.D. Ky.) an enthusiastic Fair Houses Act sexual harassment HUD election instance. The problem, submitted on the Sep 31, 2015, alleged this package of your defendants generated constant undesirable requires of a renter to have sexual favors.

Fidelity usually implement a thorough Compliance and you will Exposure Management Program and can give reasonable financing knowledge for all team involved with borrowing from the bank credit system items. Fidelity will offer the brand new Section that have information of its credit card software and you may originations to own a three-year several months. To the August twenty-six, 2004, the united states submitted a complaint and concur decree in All of us v. Falcon Advancement Team No. (D. Nev.), a fair Housing Work pattern otherwise practice instance alleging discrimination on the the basis out of handicap.

To the Powering Men’s Roger Middle Courtroom $a hundred, Hoka Males and Women’s Clifton 9

The brand new criticism alleges one to Fidelity discriminated considering national resource by the entering abusive range strategies within the credit card system which harassed consumers for the base on the Latina federal resource. They subsequent alleges one to Fidelity, making use of their relationship with such third parties, failed to thing handmade cards inside compliance for the ECOA. Beneath the terms of the fresh Settlement Contract and you can Acquisition, Fidelity offered to spend $1.six million dollars to compensate the fresh victims ones violations and you will to fund a consumer Training Program.

Inside April 1998, an excellent jury found Larger D Companies, Inc. as well as owner, Edwin Dooley, had discriminated up against prospective Ebony clients from the about three Fort Smith, Arkansas apartment buildings. The us got registered this situation immediately after a choice because of the the new Agency away from Property and you will Urban Advancement HUD one reasonable result in resided to believe that defendants refused to rent so you can an enthusiastic Dark colored home. Our criticism, submitted on the February 13, 1997, extra a state that this refusal to rent to black colored persons is actually part of a cycle otherwise practice of racial discrimination inside the apartments. The brand new jury and given all in all, $101,000 within the compensatory and you may punitive damages for the a couple of houses affected because of the defendants’ strategies. The new defendants appealed the newest jury decision and the section court’s injunction prohibiting the newest defendants of engaging in coming serves away from discrimination. The brand new 8th Routine Courtroom out of Is attractive affirmed the newest region court’s judgment and its particular view is said from the 184 F.3d.

The complaint, that has been recorded inside November 2008, alleged that the defendants violated the brand new Reasonable Property Act by adopting and maintaining an insurance plan prohibiting the usage of motorized wheelchairs and you will scooters from the Rathbone Later years Community’s well-known living area during meals plus all the residents’ rentals. Under the terms of the newest agree buy the corporate operator away from the new Rathbone Later years Area, a pension house to have persons years fifty-five and you can more mature, and the facility’s director, Norma Helm, would need to shell out all in all, $70,000 to 3 previous people of the property, establish an excellent $25,100000 settlement money, and you will spend the money for government an excellent $21,one hundred thousand civil punishment. The fresh concur acquisition as well as necessitates the defendants to include reasonable property training to have group, follow nondiscrimination and you may practical holiday accommodation regulations, and keep maintaining and complete information to the Us to your two-year identity of the acquisition.

Finest Courtroom asks Center, Civic Government to spell it out regularisation from unlawful colonies out of wealthy within the Delhi

The criticism, filed for the July twenty-eight, 2015, so-called your accused discriminated facing a group house supplier and you can around three residents because of the residents’ mental disabilities within the solution away from the brand new Fair Property Work and the Americans that have Disabilities Work. The new decree, which also resolves a personal suit introduced because of the supplier, necessitates the offender to expend $twenty five,100 inside monetary injuries for the vendor and $twenty five,000 on the authorities while the a municipal penalty, and will be offering to own comprehensive injunctive recovery, such as the business of a neighborhood conformity coordinator. Included in the settlement, the city followed certain zoning amendments and you may an extensive practical leases coverage.

Air Michael jordan cuatro “White Cement” And much more Losing In-may

The fresh report of interest contended you to definitely preemption doesn’t apply because the the fresh Fair Housing Act especially provides for county businesses to research homes discrimination issues if they are authoritative by HUD since the having laws and you can administration steps which can be drastically comparable to the brand new government legislation. To your August 23, 2011, the brand new courtroom offered summary wisdom in favor of PHRC and you will refused to enjoin the investigation. For the October eleven, 2013, the new judge registered a consent buy in Us v. Southport Lender (Elizabeth.D. Wis.), a good Housing Operate and you will Equivalent Borrowing from the bank Options Work pattern otherwise practice that has been called by the Federal Deposit Insurance policies Company. The complaint, which was registered concurrently for the consent purchase to the Sep 26, 2013, the brand new so-called the ones from 2007 to help you 2008, Southport billed higher representative charges to the general mortgages made to African-Western and you will Latina borrowers than the non-Hispanic white individuals. Within the concur purchase, Southport will pay $687,one hundred thousand to African-American and you may Latina victims away from discrimination.

The brand new agreement also incorporates injunctive save, as well as forever barring Hatfield away from participating in the new local rental, product sales, or investment of properties. On the April twenty-five, 2019, the us registered the brand new agreement for the Courtroom and you can requested the newest Legal to retain jurisdiction in order to enforcement the terminology whilst dismissing the underlying step. To your February 8, 2006, the new court joined the brand new consent order in You v. Grand Canyon Businesses, Inc. (D. Nev.).

The usa Attorney’s Office as one examined and you can litigated the way it is inside venture to your Justice Department’s Civil-rights Department. To the October 28, 2013, the fresh courtroom joined a consent decree in Us v. Rosewood Playground Leases (D. Nev.), a period otherwise routine/election circumstances. The ailment, which had been submitted on the November 15, 2012, alleged that residents and providers of one’s largest flat complex within the Reno (902 equipment) rejected houses so you can people having handicaps just who explore direction pets.