Articles

- Make an application for an enthusiastic ETA

- The united kingdom Statutory Abode Examination Action-by-Action

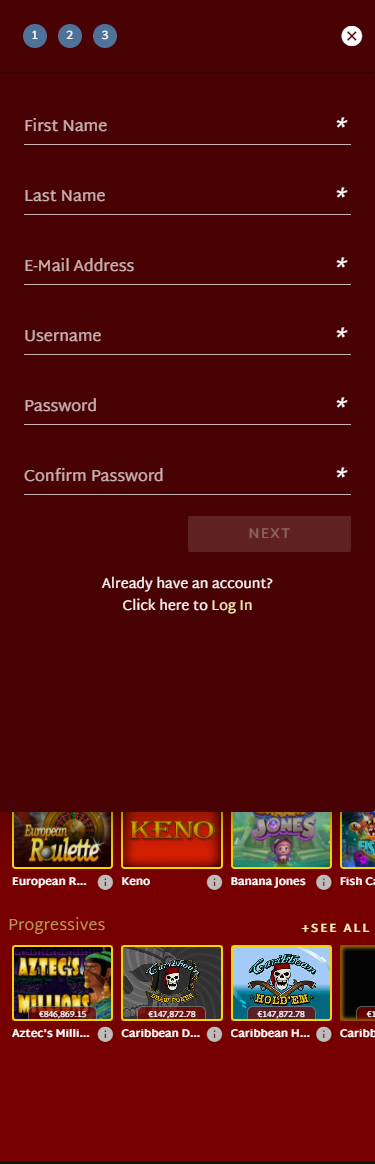

- A dysfunction of the the brand new name confirmation alter

- consider to your “Statutory House Test Told me For Expats”

- I’yards not United kingdom, however, My home is great britain – can i file a taxation come back?

People which have a full time income out of 125,141 or maybe more would be subject to the best speed away from income tax away from forty fivepercent. For individuals who secure over a hundred,100 in the uk, your allowance was smaller from the step 1 per dos made more than a hundred,100. As a result for those who earn more than 125,100 inside the an income tax year, you would not discover an individual allocation.

Make an application for an enthusiastic ETA

One method to defeat so it challenge is via delivering a lender declaration from another lender while the address verification. Darren Fraser are a good Chartered CISI representative excited about taking designed economic advice to expats. Specialising inside the income tax efficiency, your retirement planning, British property financing, loved ones protection, and you will lump sum opportunities, Darren will bring expatriates worldwide with methods to satisfy diverse financial needs. Because the a writer to the expat taxation, he now offers knowledge one empower members to help you optimize its financial futures. If your’re also moving to the united kingdom, leaving, or life style overseas, the brand new Legal Residence Test is majorly effect your earnings tax, money gains, and you can heredity taxation.

In case your manager decides which you’lso are perhaps not admissible to Canada, your won’t be permitted to enter into Canada. For many who arrived by the air, you’ll have to take a profit flight to help you the place you appeared from. After you are available, i look at the name so that you are the exact same individual that try recognized to journey to Canada. Flight team and you will edging services officers from the ports away from admission often query to see your own traveling documents. If you don’t have them, you might not manage to board their airline to help you Canada.

The united kingdom Statutory Abode Examination Action-by-Action

If you meet with the considered domicile laws, you will not manage to allege the fresh remittance foundation of taxation and you will be assessed in your worldwide income and gains on the developing foundation rather. While the a good United kingdom resident non-domicile individual with well over dos,one hundred thousand in the overseas income or development, there is the option of becoming taxed on the two base, the new arising basis and remittance basis. Great britain have a property-founded taxation program, and therefore if you are thought tax citizen from the United kingdom, you will often have to expend HMRC tax to your every one of your global earnings.

A dysfunction of the the brand new name confirmation alter

- By using these types of steps, you can correctly influence their abode status and you will take control of your tax financial obligation effectively.

- When we can be’t make sure the label, you’re detained from the a border characteristics administrator.

- The test for just what constitutes ‘work’ is fairly wide and will also hook incidental responsibilities.

Find out what goes from when your complete the application in order to when you get to help you Canada and you may where biometrics fits in the brand new process. Understand who must offer biometrics as well as how the brand new visit application techniques functions. That’s why we provide complete Legal Household Attempt advice designed to help you your unique items, making sure you can control your tax financial obligation effortlessly and you may with full confidence.

For this reason, While you are computed to be a low-citizen from automatic overseas tests, you do not have to consider these testing. If your software program is effective, you’ll learn simple tips to consider your own immigration position during your eVisa. If your software is successful, you’ll found a decision observe that has the new standards of the give from permission to remain in the uk.

consider to your “Statutory House Test Told me For Expats”

You could consistently establish the liberties utilizing your present bodily documents in which he or she is let when you’re your NTL software program is getting sensed and you will after it’s decided. This consists of to possess proving your right-to-work in case your document have not expired, directly to lease or for go to the united kingdom. You can watch videos about how to confirm their immigration condition having an eVisa.

This web site doesn’t render customised financing suggestions and disregards private financial points. Whether you’lso are concerned about taxation, money growth, or genetics tax ramifications, all of us guarantees the tax believed try efficient, compliant, and you will tailored for the demands. Errors inside the choosing your own tax residency position may cause extreme monetary ramifications, underscoring the necessity of getting hired proper the first time. Navigating the challenges out of separated 12 months medication demands a comprehensive understanding of your own standards for every specific case, therefore it is difficult.

But if you come in question or need help, you should consult an introduction to one of our United kingdom income tax specialists. For individuals who work with the united kingdom, unless taxation has already been subtracted by your boss from spend since you secure system, one work you are doing will be taxable and you may hence be required to done a tax get back. If the money could have been derived because the a pals manager (for example returns), assets, self employment, funding gains otherwise overseas gained income try to over a minumum of one secondary setting(s). The new share code can get been emailed for your requirements otherwise provided for you from the individual whoever position you’re checking.

There’ll be guidance and suggestions provided during your application process if you want to do a great UKVI account. For individuals who don’t provides a great BRP, you can use your good identity file, just like your passport, and your charge software resource number to produce your account and you can accessibility your eVisa. You should maintain your passport or ID cards details as much as go out on your own UKVI membership and you will write to us in the people change, so that your immigration position can be simply understood, in addition to in the Uk border. Updating their bodily file in order to an enthusiastic eVisa will not apply to your immigration reputation or even the conditions of your consent to get in otherwise stay static in great britain.

I’yards not United kingdom, however, My home is great britain – can i file a taxation come back?

These financial institutions can offer Euro savings account choices, as well as latest accounts having benefits such international money transfers and you will multi-currency membership choices. Electronically access the international banking account and assets twenty-four/7, wherever you’re in the world and sustain the important data files secure and safe with the easy to use mobile app. For many who’ve went to another country, an international bank account can help you discover a safe and you may safe family for your money, enabling you to bank in the numerous currencies and you can send money family effortlessly. Biometric household it allows (BRPs) try cards that have been always prove immigration reputation. You have a good BRP if you were provided consent so you can real time or work in the united kingdom to your or just before 29 October 2024.

This really is achieved when the fundamental 325,000 income tax-totally free allowance – known as nil-speed ring – are combined with the brand-new house nil-speed band, worth around 175,000. While you pays British taxes, you also rating Uk income tax advantages, such as tax recovery for the pension benefits and investment on the Seeds Business Financing Plan (SEIS) and you will Firm Money Plan (EIS). Taking the attempt form working very carefully from the laws and regulations and you may truthfully depending the amount of months you invested in britain. The brand new Statutory House Attempt try a notoriously complicated group of regulations better spent some time working through with a qualified professional used to what the law states.