Hey, I’yards Kelvin Nielsen, a skilled landlord and you may accomplished a property lawyer. My personal attention is on reacting your questions regarding the leasing regarding the hopes of making your daily life as the an occupant otherwise a landlord a little while much easier. There’s no limit to your number of rent which can getting accumulated initial in the Vermont. If the property manager chooses to exercise, then any interest accumulated could be the property manager’s to save. Provided in the zero circumstances, will the quantity, or time of the first deposit, go through improvement in any trend in case your deposit try an excellent identity put. 8.cuatro Conversion out of NRE deposit on the Forex Non-Resident (Banks) FCNR (B) put and vice versa prior to maturity by a financial allowed to manage FCNR(B) places, is going to be susceptible to the brand new penal supply per early detachment.

Apartment Defense Deposit Laws All 50 Us Says

When write-offs try extracted from a security deposit, property managers must provide created notice to the resident (Fla. Stat. Sec. 83.49(3)(a)). So it find must through the exact count deducted plus the particular reasons for the brand new deductions. Florida’s shelter deposit laws, mostly found below Florida Regulations Section 83.forty two, as well as almost every other legislation less than property owner and renter legislation, explanation the newest liberties and you will debt away from assets managers and you will people about the the newest dealing with, refund, and you may permissible write-offs of security dumps.

Exactly what do a landlord Subtract from a protection Put?

- Landlords need to get back a protection put which have a keen itemized statement from write-offs, or no, on the occupant’s last identified target no afterwards than simply 45 weeks pursuing the necessary standards were came across.

- The newest visibility is generally an identical count because the refundable put and offers protection to have loss of lease, ruin or other costs a refundable put create typically shelter.

- People damages the newest lessor have suffered from the cause out of deteriorations or injuries to your property or house because of the lessee’s pets otherwise from the carelessness of your lessee or even the lessee’s invitees.

- Any too much withholding will be refunded on the fresh filing from a keen tax get back appearing an overpayment out of income tax.

- Residents can also be discovered a refund thru their popular refund method – ach ,credit, debit, venmo, paypal – in this times of flow-away running.

- In the event the, inside 12 months, the new spouse no more match the needs for exemption on the internet cuatro, the fresh partner need to over a new Form NC-4 EZ.

They’re also employed for anyone to the straight down revenues, just who wouldn’t manage to acquire sufficient to pick one hundred% of property in the area it live. According to for which you get as well as how much your use, their home loan repayments which have a great 95% financial might possibly be less than rent. To have earliest-time buyers the brand new amounts that people need to conserve to-arrive a good 5% otherwise ten% put are larger as well.

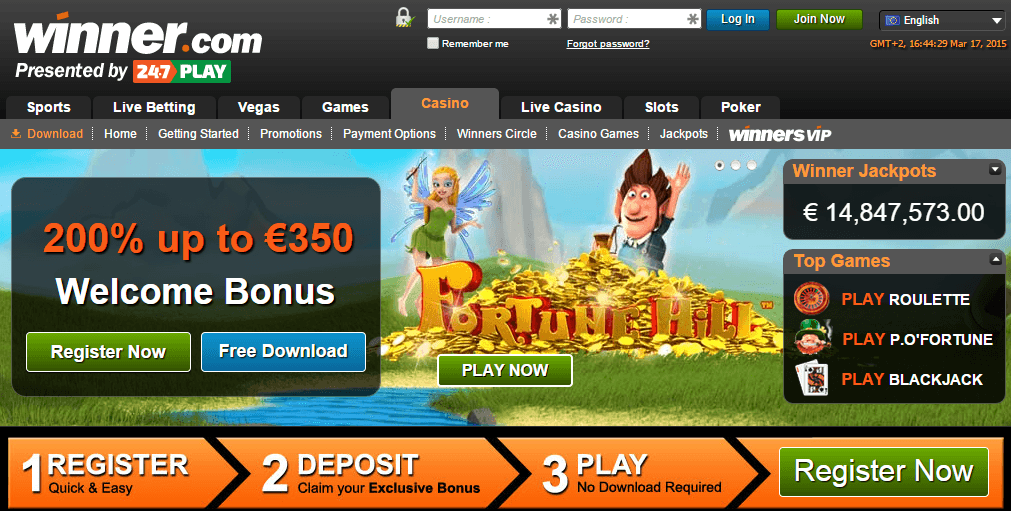

To own amounts https://zerodepositcasino.co.uk/free-5-no-deposit/ greater than which, the new tenant must file from the regional Circuit Legal. When the a landlord fails to return the protection put, the new tenant can be document a conflict in the Small claims Legal when the the degree of problems is actually lower than $3500. If the matter is actually greater, the brand new renter have to document a civil situation within the Circuit or State Judge. Landlords do are obligated to pay focus to your security deposits, but as long as they’lso are stored for example seasons or extended.

It requires mindful auditing and you will possibly recalculating the newest accrued desire in order to ensure that the the new property owner try certified having judge conditions and fair to the renters. Of a lot audits neglect to account for so it properly, making the fresh holder for the responsibility. The newest difficulty appears inside record this type of desire quantity throughout the years, specifically which have numerous renters and various book start schedules too since the speed change over time.

What things to Consider When Enjoying a home More Guide

While the rents always go up, protection deposit choices are coming more for the enjoy. Deposit cost agreements, rent insurance policies and you will surety bonds are wade-so you can answers to manage possessions while you are reducing the rates to own residents. Including, claims can be restriction the degree of the protection deposit, when a landlord can be receive the finance, if the landlord is also withhold the cash, and exactly how easily the new landlord needs to return the fresh put immediately after the new book comes to an end.

- The fresh spouse have to done Mode NC-4 EZ, Employee’s Withholding Allotment Certification, certifying the companion is not subject to New york withholding because the criteria to own exemption had been fulfilled.

- Workers need to manage their possessions against owners just who aren’t a good stewards of the renting.

- Extremely smart landlords within the North carolina, however, charge defense deposits perhaps not surpassing the equivalent of two months’ book.

- Landlords don’t have a specific deadline on the return from a protection put.

An informed Mortgages for Pros

For property executives and you will landlords inside the Nj, this involves meticulous tracking and you may accurate formula from combined attention so you can ensure conformity that have state legislation. DepositCloud are a casino game-changing protection put management system that have an enthusiastic unwavering 100% use rates. There is absolutely no limitation about how precisely much a landlord can be gather to own a security deposit inside the Oklahoma.

You need to use such versions plus the tax tables found regarding the book, NC-29, to decide exactly how much taxation will be withheld from for each employee’s paycheck. When a taxpayer records to have withholding tax, the new Agency informs the fresh taxpayer of the submitting needs by the page. The newest letter means the fresh filing frequency the new taxpayer is tasked in the enough time out of subscription. The fresh Department condition withholding tax filing wavelengths one time per year, and generally in the September sends characters to the influenced taxpayers demonstrating their new processing specifications. The fresh filing volume will be based upon an average number of withholding income tax the new taxpayer withheld in the a good 12 few days period one ended for the June 30.

When it’s not yet determined, definitely pose a question to your landlord about how precisely you get their put back before signing your own book, and have it on paper. Be sure to demand an attorney for those who’re unsure on the one area of the techniques otherwise lease agreement. It’s also important to note one tenants will likely be stored economically guilty of maybe not caution its landlord to certain items such as shape growth.

If claiming exemption away from withholding, the brand new certificate works well for starters twelve months and you will an alternative certificate need to be accomplished and you will made available to the fresh boss by March 16 to maintain exempt status for the next income tax 12 months. If the a different Form NC-4 EZ is not provided with March 16, the newest company must keep back considering solitary status that have zero allowances. If, inside the season, the fresh partner no more suits the requirements to own different on the web 4, the fresh companion must over a different Mode NC-cuatro EZ. (4) shall forfeit the ability to believe a separate action contrary to the resident to possess damage to your rental assets.